OSB Group is a leading specialist mortgage lender, primarily focused on carefully selected sub-segments of the UK mortgage market.

#1 specialist lender

OSB Group operates a holistic lending strategy and is an experienced and diversified lender with deep expertise in Buy-to-Let, specialist Residential, Commercial, Asset finance, Residential development and Bridging. For 2024, OSB Group was the largest independent Buy-to-Let lender in the UK.1

2027-2029 Aspirations

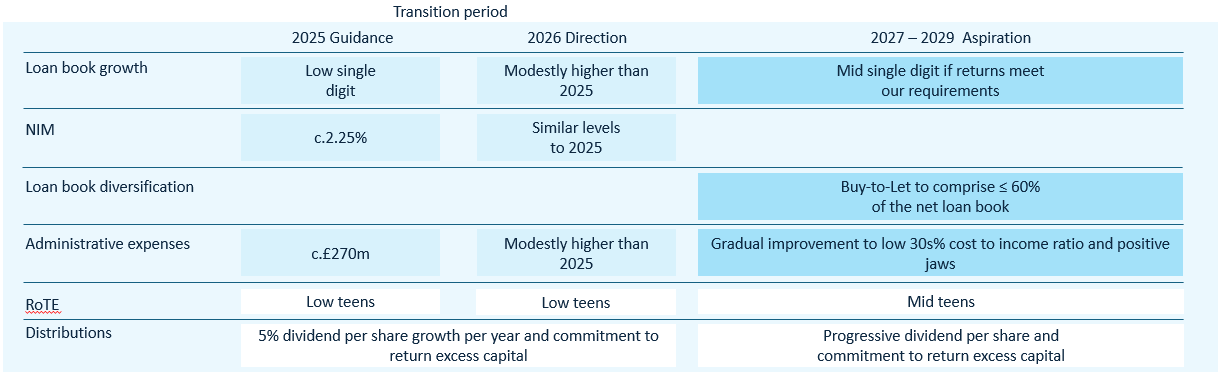

In March 2025, the Group published its Investor update which included 2026 direction and medium-term aspirations for 2027-29, as below:

Our competitive advantage

The Group offers a one stop shop for our intermediaries with a breath of complimentary yet differentiated lending propositions. The Group is funded by two established retail savings brands: Kent Reliance and Charter Savings Bank as well as opportunistic wholesale issuances. The wholly-owned subsidiary OSB India provides a structural advantage to the Group, with access to talent, excellent customer service and cost effectiveness.

Highly capital-generative

The Group is strongly capitalised with a proven track record of capital generation through profitability. This allows it to support growth as well as distributions to shareholders. In 2025 and 2026, the dividend per share is expected to increase by 5% per year and is committed to returning excess capital to shareholders.

Consistent returns

Since its IPO, the Group has consistently generated attractive returns, driven by strong growth in its specialist market sub-segments and sound risk management.

1. UK Finance, Value of BTL gross lending, July 2025